How It Works

Step 1

Information about your leased vehicle

Step 2

View your options

Step 3

Sign your paperwork all from the comfort of your home

Step 4

Rest assured we got it from here

Why Clients Choose Us

100 percent completely online

Competitive rates and coverages

Sign all paperwork from anywhere

100 percent secured online transaction

testimonials

What Clients Say

What Clients Say

Latest News

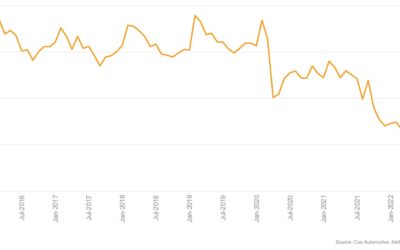

Leasing Decline Has Short-Term and Long-Term Implications

Leasing is an important financing option for potential shoppers in the new-vehicle market. New vehicles financed through an auto loan generally have a higher monthly payment. Thus leasing provides an affordable “bridge” to new vehicles for people who cannot afford to purchase outright.

Additionally, leasing has been an important option for potential buyers who don’t want to commit to a vehicle, its aging technology, and its purchase contract for more than three years.

Sticker shock pushes shoppers out of new-car market as affordability crisis deepens

Auto industry experts say consumers turning to used cars find little relief as prices remain elevated

A growing number of consumers are shying away from the new car market as prices increasingly become out of reach. But used cars aren’t offering much relief either, according to auto industry experts.

Joseph Yoon, consumer insights analyst at Edmunds, told FOX Business that shoppers are contending with the highest average monthly payments and highest average loan balances ever seen at Edmunds. The company’s data from October, the most recent on record, showed that the average monthly payment for a new vehicle reached a new all-time high of $766. The average amount financed toward a new vehicle also topped a new record at $43,218.

It’s putting additional pressure on shoppers at a time when consumer confidence has continued to deteriorate.

Car Payments Now Average More Than $750 a Month. Enter the 100-Month Car Loan.

The price of new cars and trucks in the U.S. has increased 33% since 2020, and consumers are piling on interest as they stretch out loan terms to eight, nine and nearly 10 years.

David Kelleher, who runs a Dodge and Jeep dealership in Glen Mills, Pa., 27 miles west of Philadelphia, said many American families can’t comfortably take on a new-car payment these days.

“We don’t have $300 monthly payments any longer in new vehicles,” he said. “It’s a thing of the past.”