Leasing is an important financing option for potential shoppers in the new-vehicle market. New vehicles financed through an auto loan generally have a higher monthly payment. Thus leasing provides an affordable “bridge” to new vehicles for people who cannot afford to purchase outright.

Additionally, leasing has been an important option for potential buyers who don’t want to commit to a vehicle, its aging technology, and its purchase contract for more than three years.

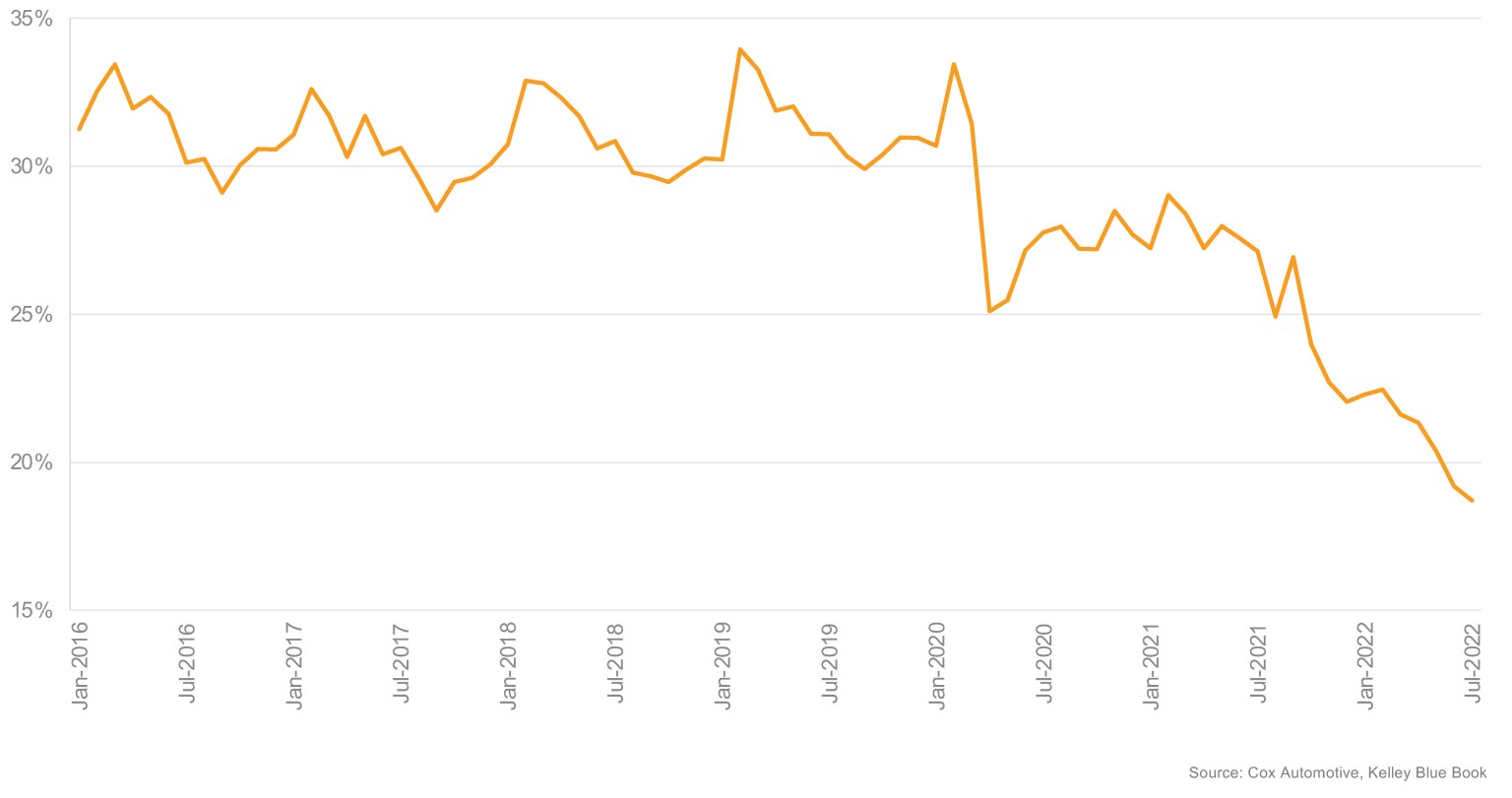

One would think that a short-term commitment, a lower monthly payment, and access to all the latest technology would make leasing especially popular in our current volatile economic climate. However, this has not been the case, as leasing’s role in the post-COVID marketplace has declined substantially, and there will be long-term consequences.

During the boom years of 2015-2019, when annual new-vehicle sales averaged nearly 17.3 million units, nearly 30% of all retail sales were leased. However, in the years since, the importance of leasing in the market has changed significantly.

0 Comments